Offices Location & Phone No.

Hongkong, China Office : (852) 2868 9205

Guangzhou, China Office : (8620) 3880 0116

Shanghai, China Office : (8621) 6331 1978

Offices Location & Phone No.

Hongkong, China Office : (852) 2868 9205

Guangzhou, China Office : (8620) 3880 0116

Shanghai, China Office : (8621) 6331 1978

International businesses that operate in Hong Kong or Mainland China are required to comply with the transfer pricing regulations set by the tax authorities. The self-assessment regime for transfer pricing makes it necessary for taxpayers to verify 'arm's length' prices on all related-party transactions, and the tax authorities impose interest and penalties for non-compliance, even if the company has made losses. International Tax (HK) Co. Ltd. is a professional firm that provides transfer pricing services to help businesses manage their transfer pricing obligations effectively.

Benefit of Services:

1. Ensure that businesses comply with transfer pricing regulations and avoid interest and penalties for non-compliance.

2. Receive tailored transfer pricing solutions, from transfer pricing reviews and planning structures when going overseas for the first time, to business restructuring and profit attribution to permanent establishments.

3. Work with Hong Kong and China team of transfer pricing and international tax specialists, accountants, and economists.

4. Receive support from over 150 transfer pricing specialists via our global network of member firms.

Scope of Services:

1. Transfer pricing reviews

2. Transfer pricing planning structures

3. Business restructuring

4. Profit attribution to permanent establishments

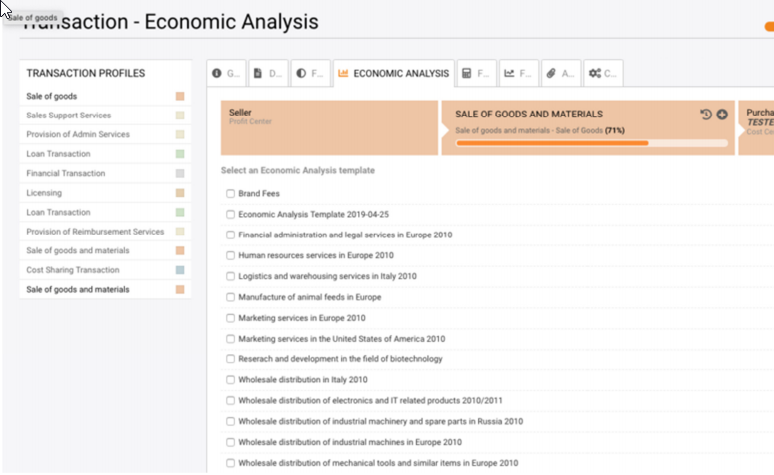

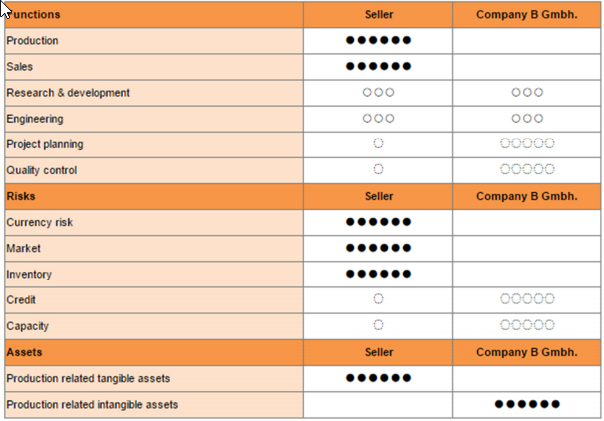

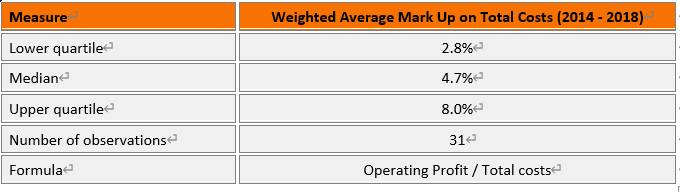

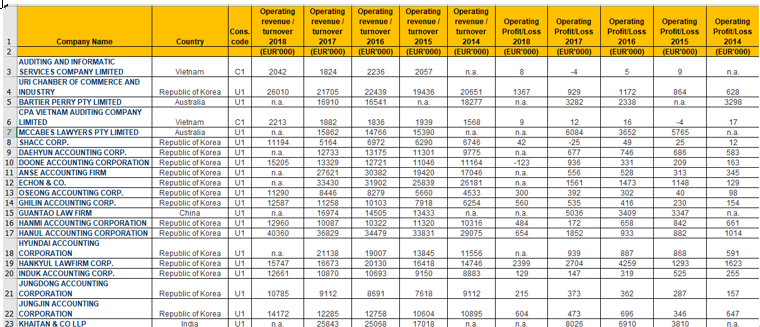

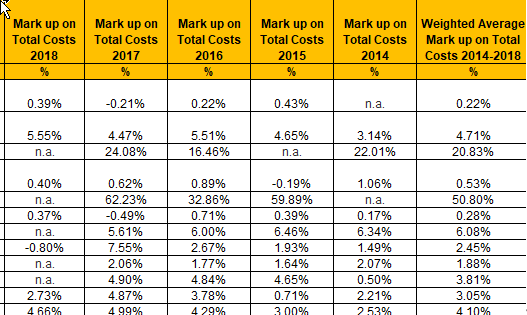

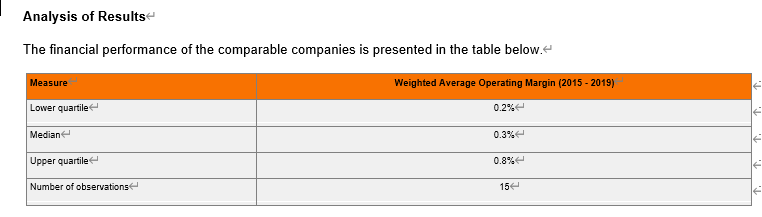

5. Comparability analysis

6. Proper transfer pricing method establishment

7. Determination of the transfer price

Why International Tax (HK) Co. Ltd. is qualified to provide transfer pricing services:

1. The firm has a team of transfer pricing and international tax specialists, accountants, and economists with extensive experience in the field.

2. The firm has a collaborative approach that brings integrated, pragmatic, and effective global transfer pricing solutions and advice.

3. The firm's transfer pricing framework helps businesses overcome increasingly sophisticated challenges and deliver relevant and sustainable transfer pricing services.

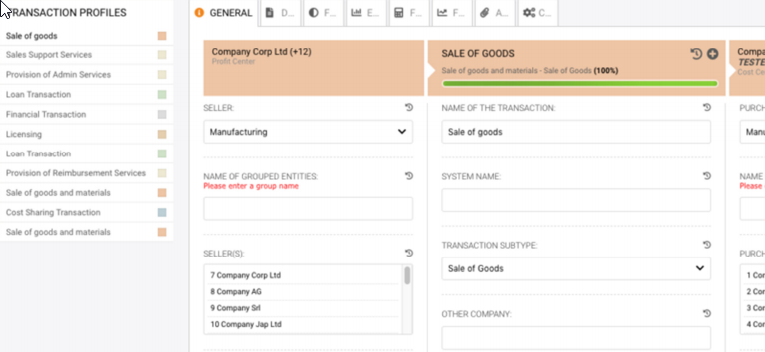

4. The firm uses the Bureau van Dijk BvD Osiris database, which is a major publisher of business information and specializes in private company data combined with software for searching and analyzing companies.

5. The firm's comparability analysis follows a four-step process, which includes identifying intra-group transactions subject to analysis, performing an analysis of the controlled transaction(s) under examination, establishing the proper transfer pricing method, and determining the transfer price.

In summary, International Tax (HK) Co. Ltd. provides transfer pricing services to help businesses manage their transfer pricing obligations effectively and comply with the regulations set by the tax authorities. The firm's team of transfer pricing and international tax specialists, accountants, and economists has extensive experience in the field, and businesses can receive tailored solutions and support from over 150 transfer pricing specialists via the firm's global network of member firms. The firm's use of the Bureau van Dijk BvD Osiris database and four-step comparability analysis process ensures that businesses receive relevant and sustainable transfer pricing services.

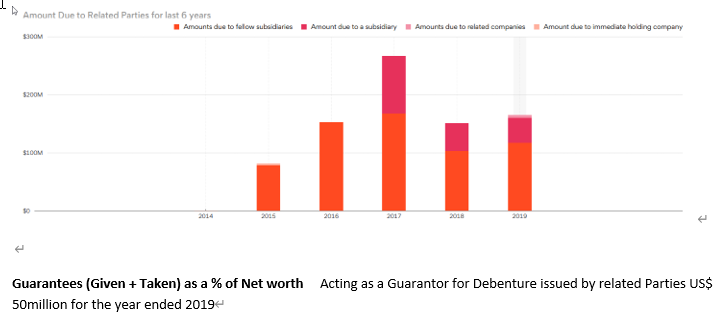

Internal comparative analysis:

Benchmark Study through global company database from Bureau van Dijk:

External comparative analysis :

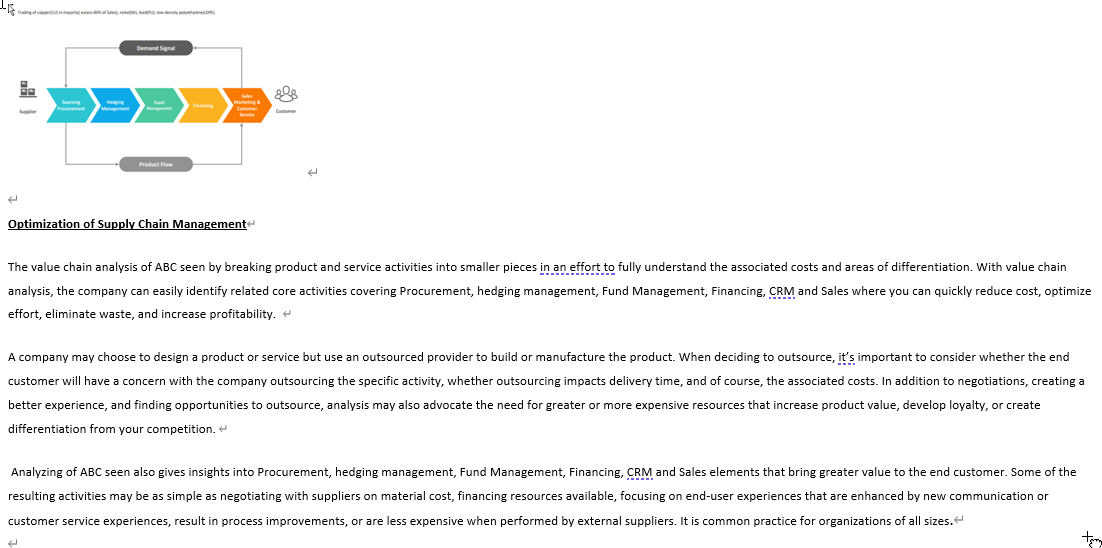

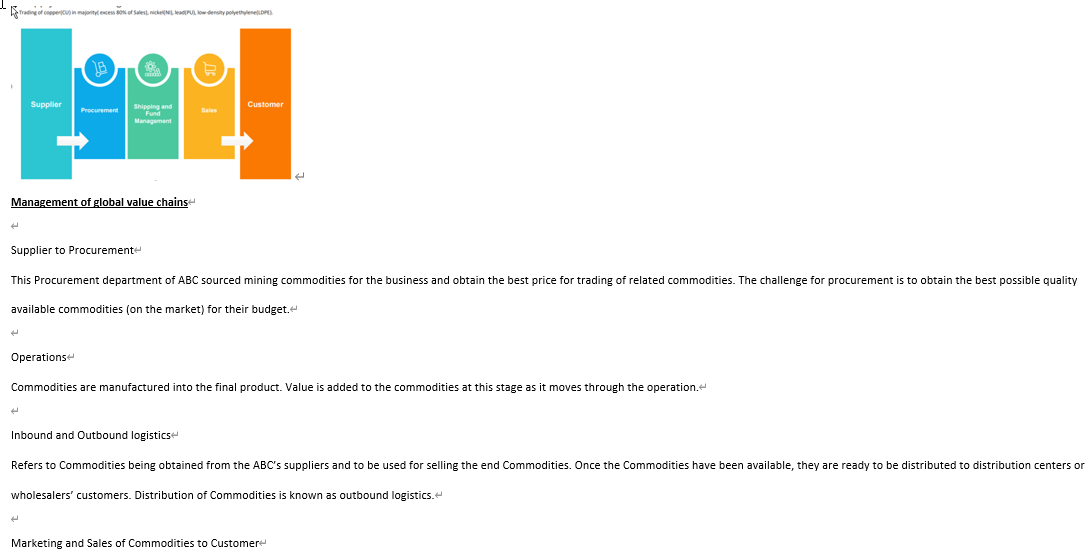

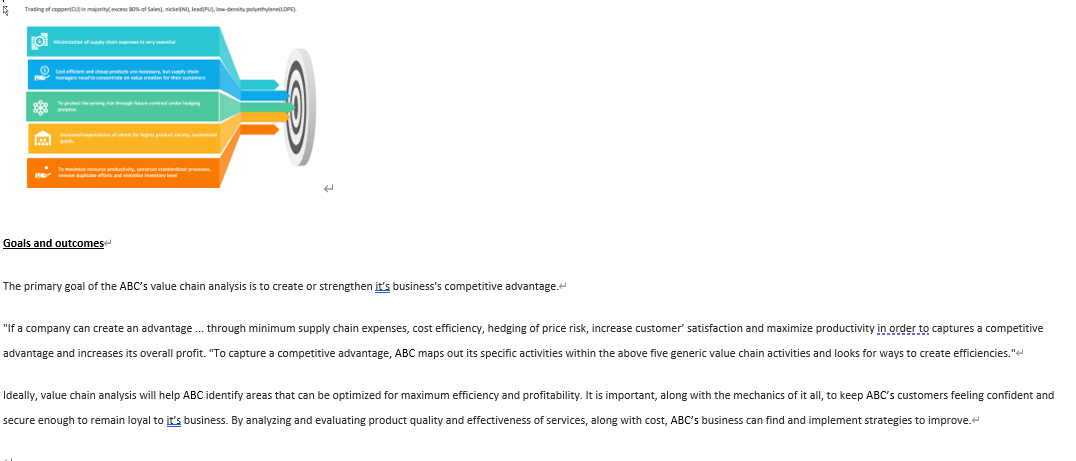

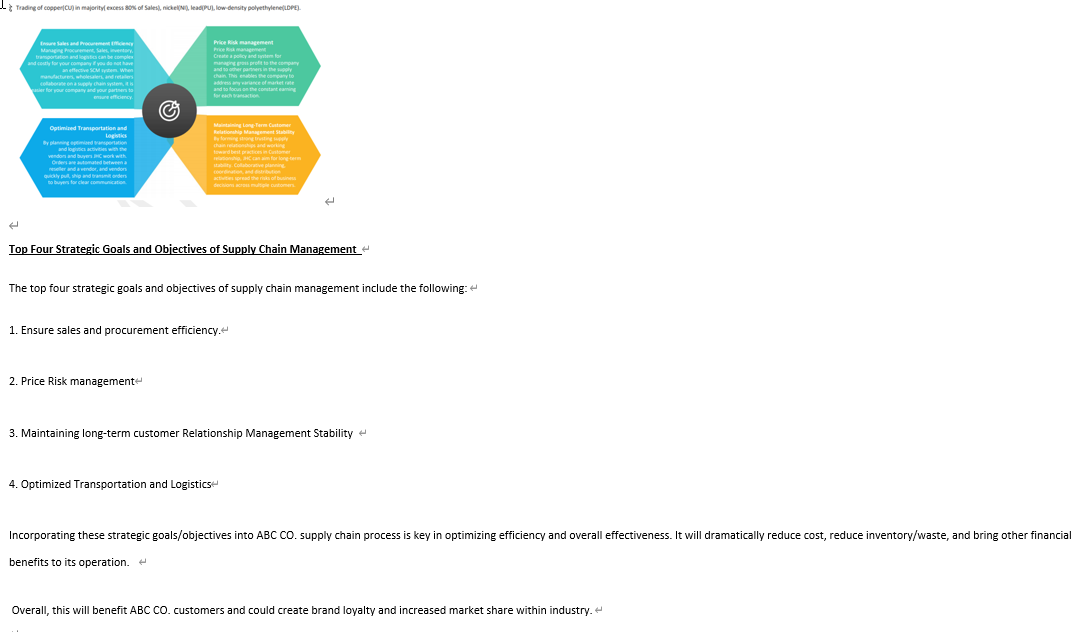

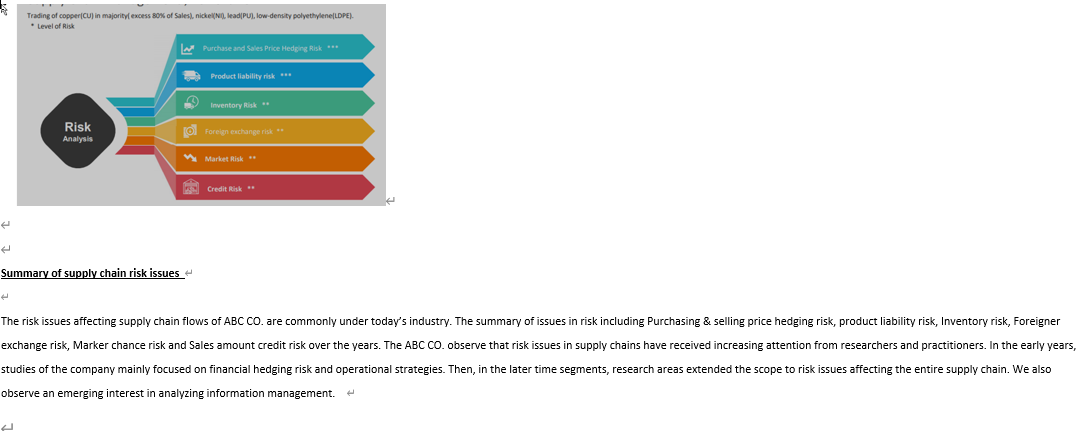

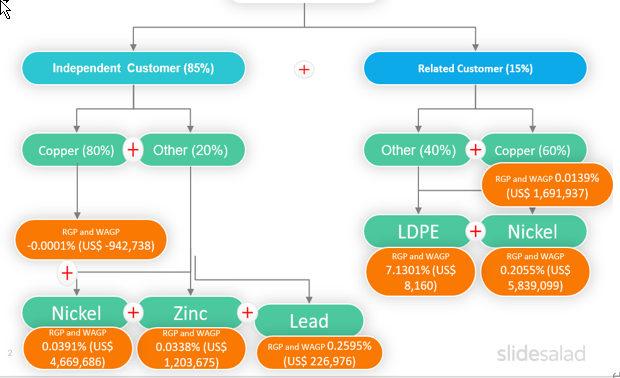

Supply chain management analysis: