办事处地点 & 联络电话:

香港, 中国办事处 : (852) 2868 9888

广州, 中国办事处 : (8620) 3880 0116

上海, 中国办事处 : (8621) 6331 1978

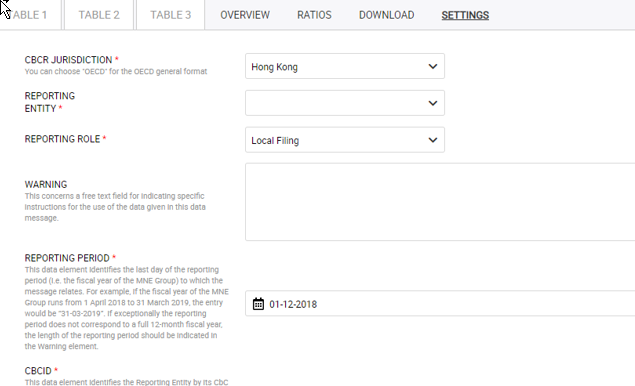

International Tax (HK) Co. Ltd. offers comprehensive Country-by-Country (CbC) Tax Reporting and Reviewing services to multinational corporations operating in Hong Kong, Mainland China, and overseas. Our expert team provides critical analysis of enhanced regulatory requirements for multinational corporations, ensuring the correct and detailed analysis of group tax figures.

The benefits of our CbC Tax Reporting and Reviewing services include:

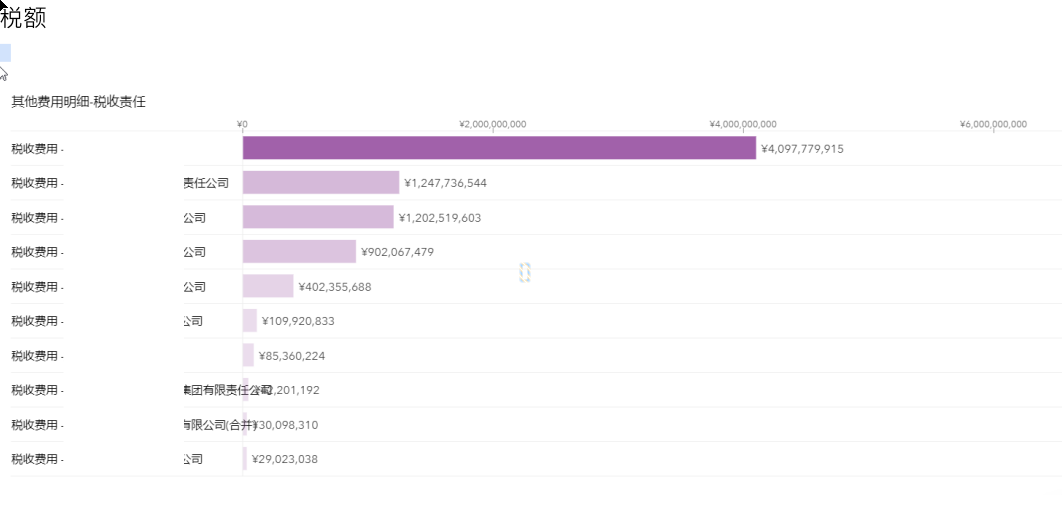

1. Compliance with recently adopted legislation that requires filing of CbC data to tax authorities, ensuring the group's tax data is correct and analyzed in detail

2. A timely framework for CbC reporting, achieving efficient management processes and reasonable control of the group's information filed with tax authorities

3. Identification of risks to ensure timely measures are taken to mitigate any potential adverse impact on the group

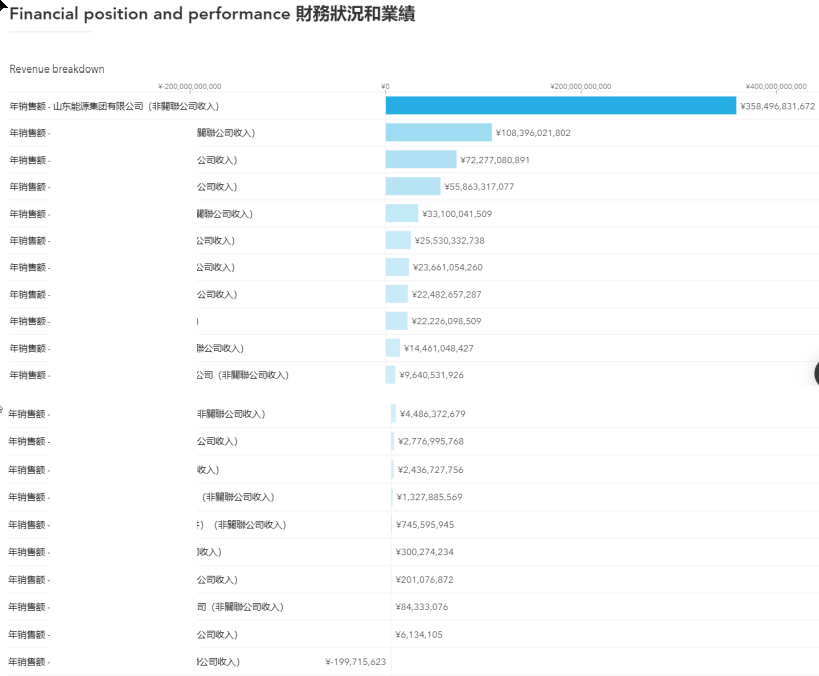

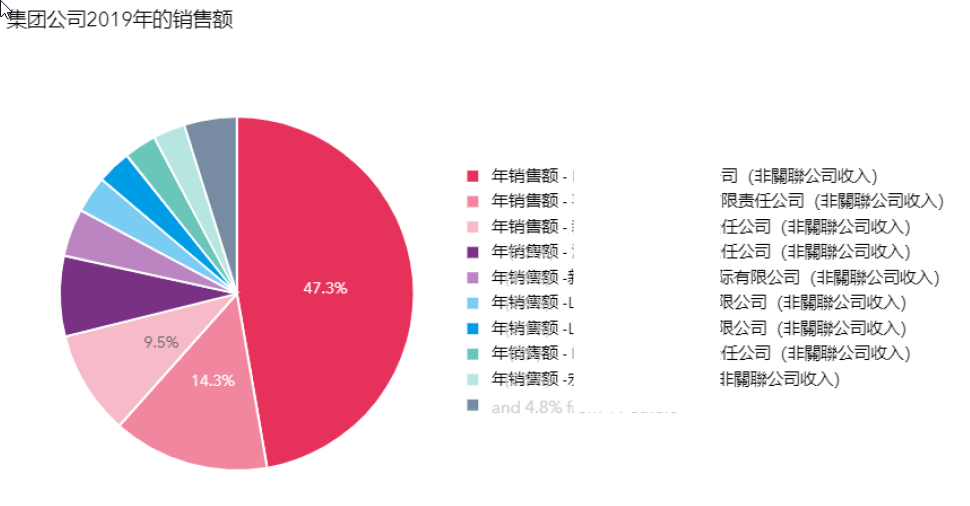

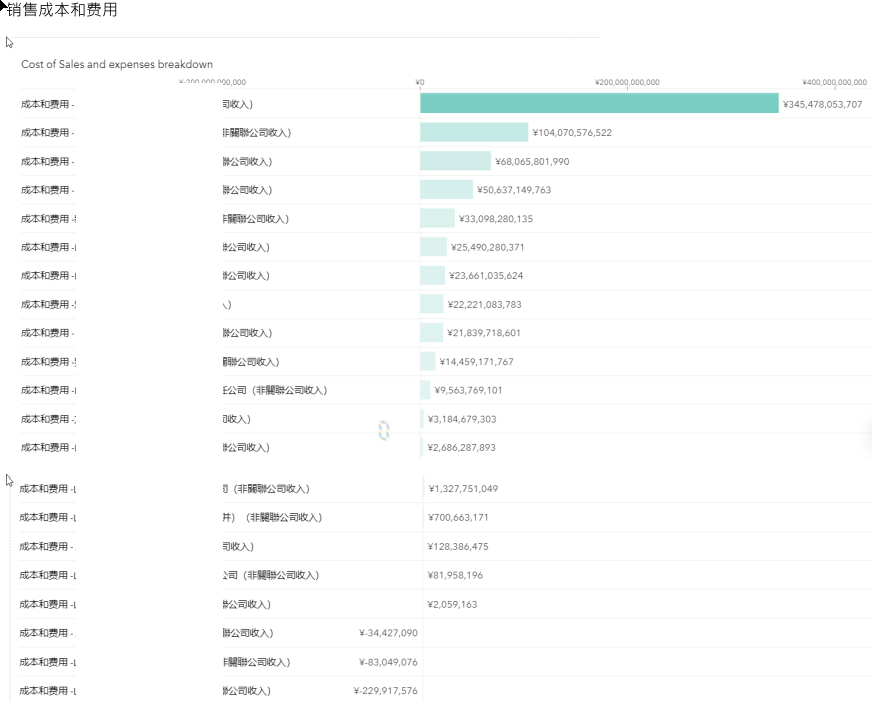

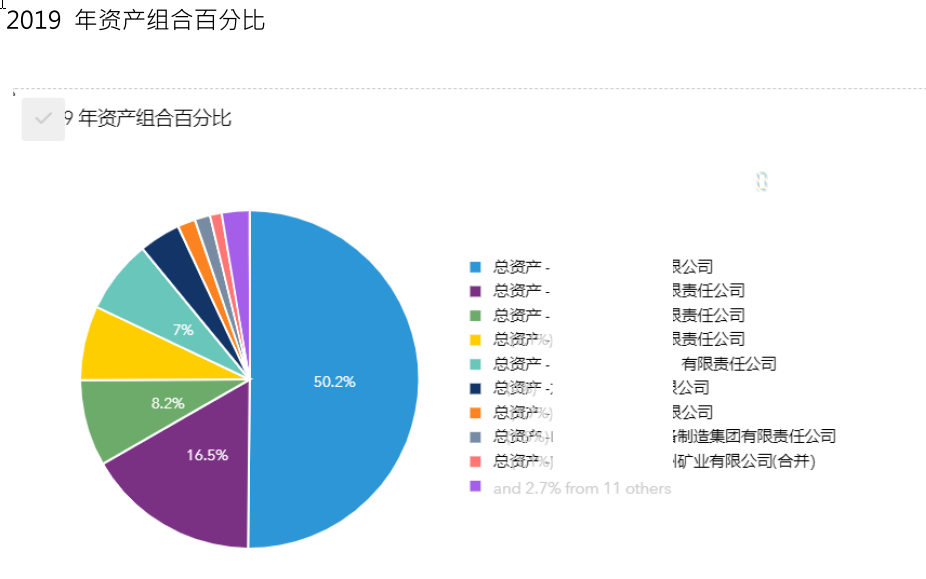

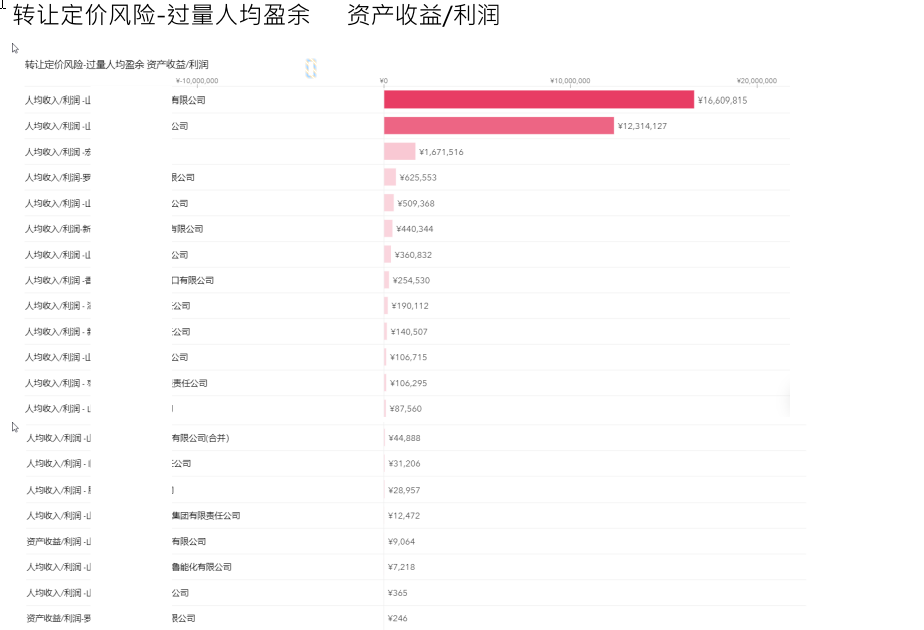

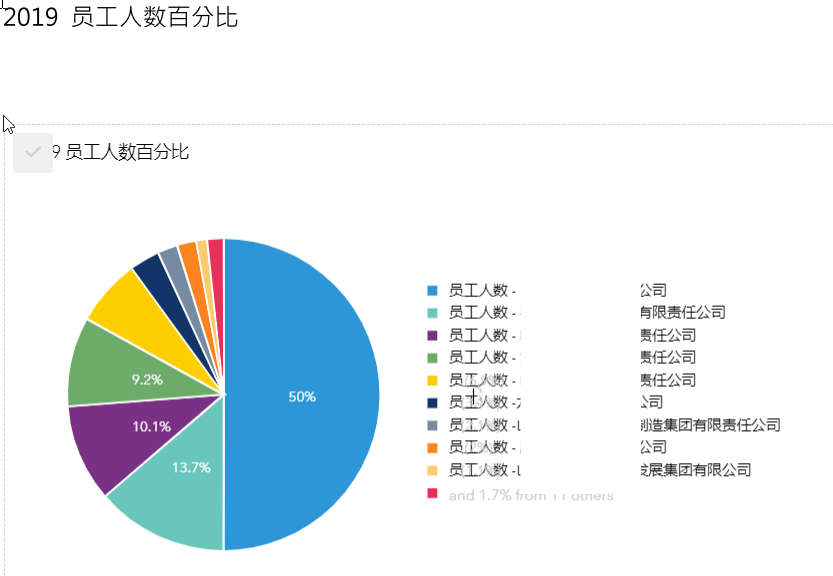

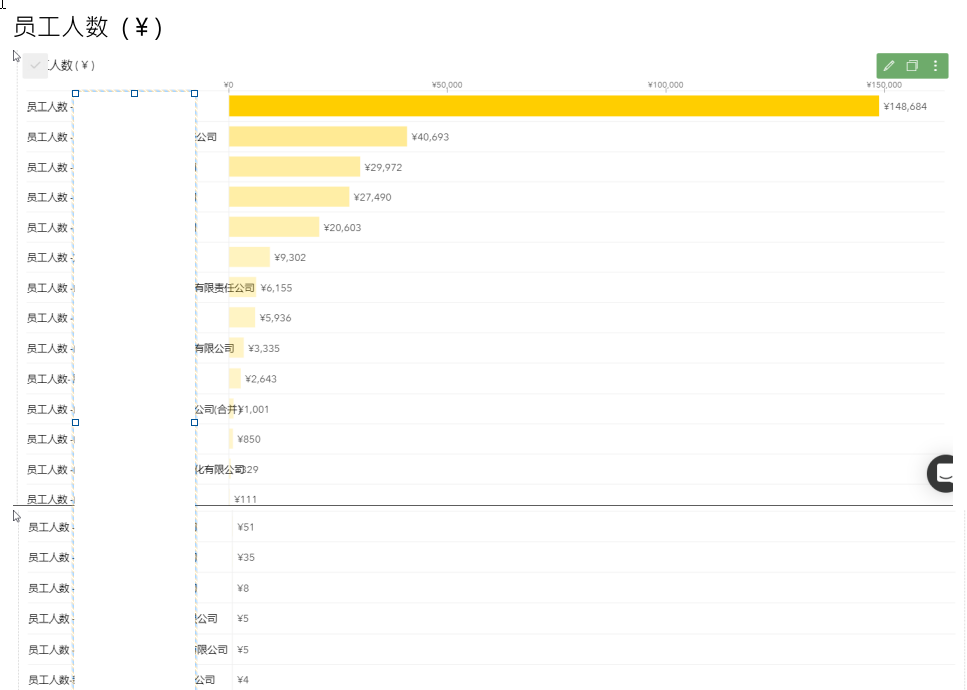

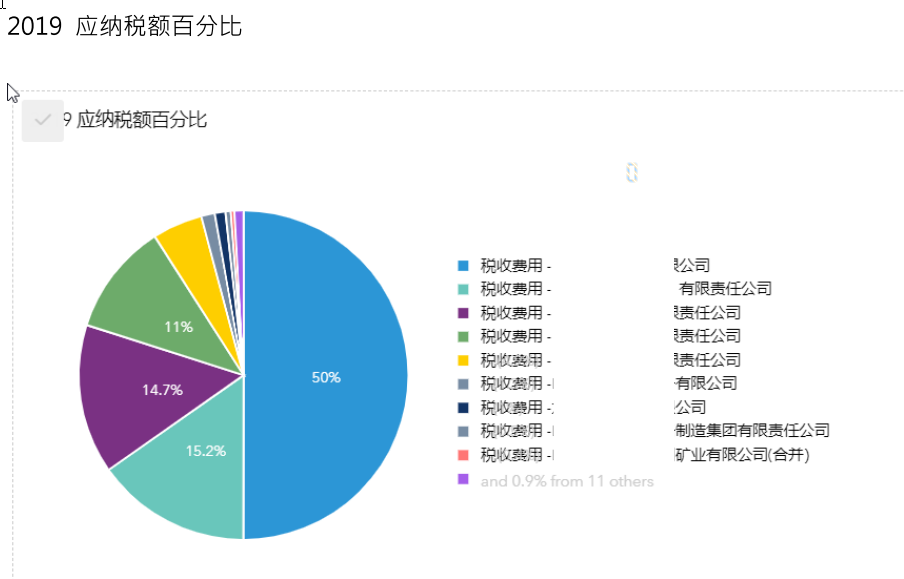

4. Assistance in analyzing CbC data, including identifying figures for analysis, relevant ratios and key performance indicators, and comparison of figures between years

5. A process for gathering, analyzing, and filing data that includes a reporting process with local managers, ensuring the accuracy of data and timely reporting

Our scope of services for CbC Tax Reporting and Reviewing includes:

1. Updated and historical company information, including permanent establishments in Hong Kong, Mainland China, and overseas

2. Tracking changes in business activities for all entities located in Hong Kong, Mainland China, and overseas over time

3. Gathering Hong Kong and Mainland China tax figures for forecast and actual figures

4. Analyzing International business's Hong Kong or Mainland China data to identify risks

5. Identifying the ratios and key performance indicators that are relevant to analyze in International business's group broken down by business activity

6. Analyzing data on a tax jurisdiction level and entity level, allowing us to identify significant differences which may attract interest from tax authorities

International Tax (HK) Co. Ltd. is qualified and experienced in providing CbC Tax Reporting and Reviewing services to multinational corporations. Our team has extensive knowledge of the current OECD guidelines for CbC reporting, ensuring our services comply with international standards. Additionally, we have a thorough understanding of the local tax regulations and requirements in Hong Kong, Mainland China, and other jurisdictions where our clients operate.

Our team adds value by providing tailored solutions to meet our clients' specific needs. We work closely with our clients to understand their business activities and provide customized advice to help them achieve tax efficiencies and mitigate risks. We also assist our clients in maintaining accurate and up-to-date records to ensure compliance with tax regulations.

In conclusion, our CbC Tax Reporting and Reviewing services help multinational corporations to comply with regulatory requirements, mitigate risks, and achieve tax efficiencies. Our qualified and experienced team provides customized solutions to meet our clients' specific needs and adds value by providing tailored advice and assistance in maintaining accurate records.